cumulative preferred stockholders have the right to receive

Cumulative preferred stocks involve low-risk investments. However preferred shareholders usually HAVE NO RIGHT TO VOTE.

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

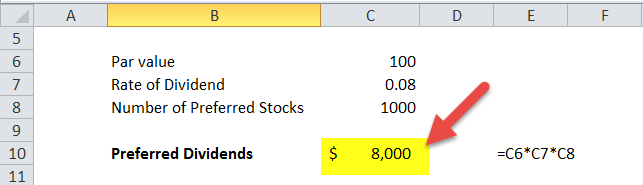

Formula Examples Worksheet 1.

. The same shareholders have a right to claim any pending dividend payment the issuing company owes them. 2 on a question. Companies must pay unpaid cumulative preferred dividends before paying any dividends on.

Neither the current years dividends nor dividends in arrears. This means that if the company does not declare dividends this year they do not have to pay preferred shareholders the guaranteed dividend amount. Has a right to receive regular dividends that were not declared paid in prior years.

Before a company can pay dividends to the common stockholders the owners of cumulative preferred stock must receive. First of all all the unpaid dividends of cumulative preferred stocks are paid and then the common dividends are. It has been determined that based on risk the discount rate would be 5.

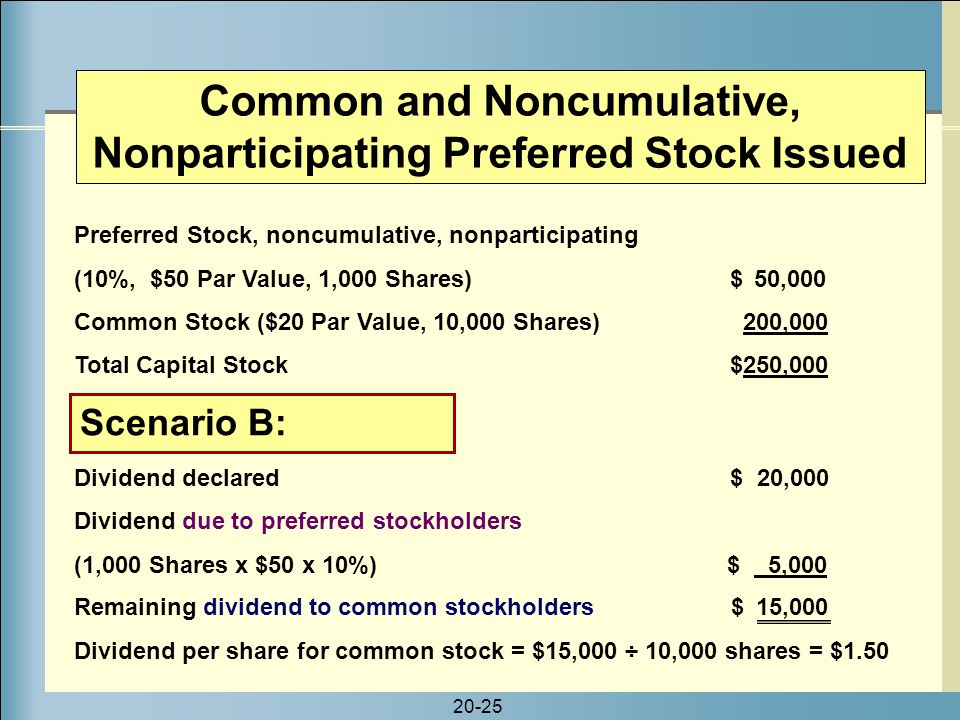

Preferred stockholders are paid dividends before common stockholders are paid dividends for the current year only. Non cumulative preferred stock does not have this right arrears cumulative preferred stock dividends that have not been paid in prior years. Because cumulative preferred stock had been issued the preferred stockholders have the right to receive 17500 in dividends before common stockholders receive payment.

Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Preferred stocks usually pay dividends quarterly. Cumulative stocks are more valuable while non-cumulative stocks are not so valuable to the shareholders.

They have the following salient features. Preferred stockholders have a right to receive current and unpaid prior-year dividends before common stockholders receive any dividends. Have priority over common stock in certain areas such as the right to receive dividends and the distribution of assets if the corporation is liquidated BEFORE common shareholders.

The current years dividends but. Preemptive right The amount per share. For example if ABC Company fails to pay the 110 annual dividend to its cumulative preferred.

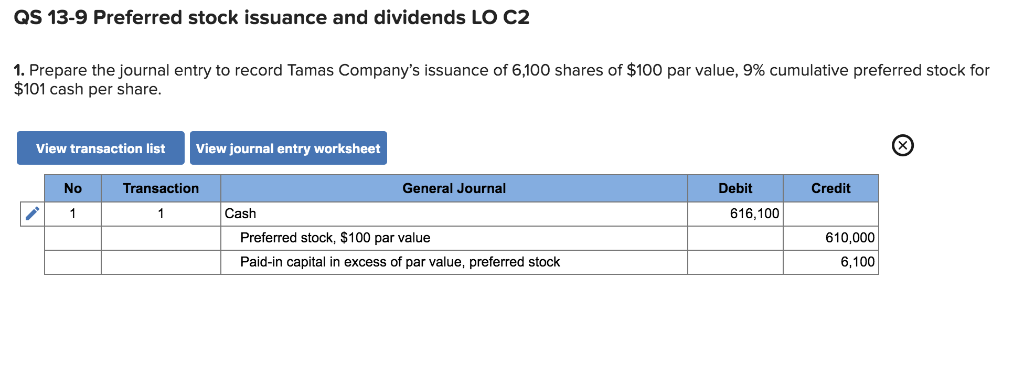

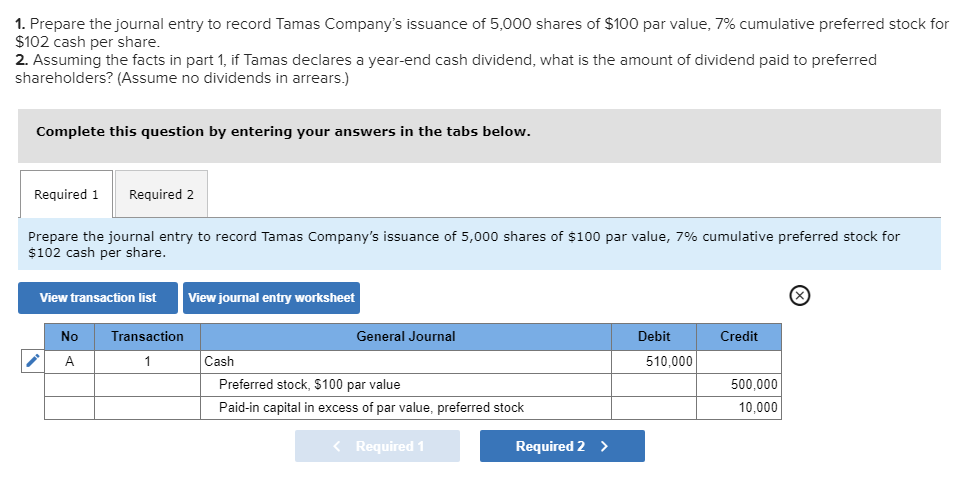

It means that cumulative preferred shares are important that the noncumulative. For journal entries there are 3 important things to know when issuing stock. A cumulative dividend is a required fixed distribution of earnings made to shareholders Preferred shares are the most common stock class providing a right to receive cumulative.

In contrast holders of the cumulative preferred stock shares will receive all dividend payments in arrears before preferred stockholders receive a payment. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. 25000 shares 10 par 250000.

All dividends in arrears but not the current years dividends. All dividends in arrears must be paid before any dividends are granted to common shareholders. Cumulative preferred stockholders have the right to receive unpaid dividends of the year in the coming years when the dividend will be declared.

The calculation of accumulated unpaid dividends depends on the term sheet. Cumulative stockholders have the right to claim their missed dividends while non-cumulative stockholders do not have any right to claim their missed or omitted dividends in the future. Essentially the common stockholders have to wait until all cumulative preferred dividends are paid up before they get any dividend payments again.

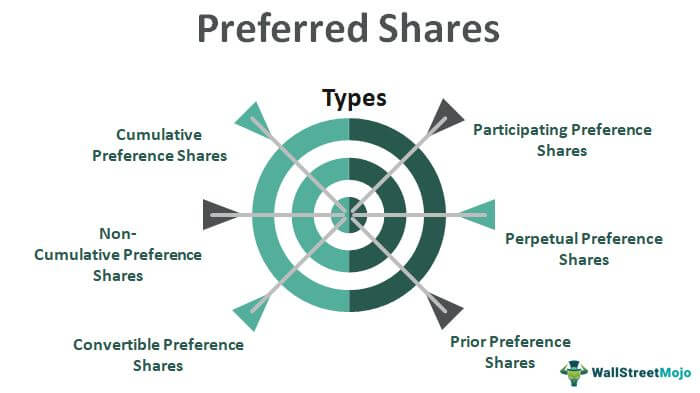

There are two types of preferred stocks. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. Issuing 1000 shares of 5 100 par value cumulative preferred stock for 110 in cash per share affects the accounting equation by _____.

Holders of cumulative preferred shares are entitled to receive dividends retroactively for any dividends that were not paid in prior periods whereas non-cumulative preferred shares do not carry. Cumulative preferred stocks and noncumulative preferred stocks. Cumulative Preferred Stocks are considered one of the most popular equity financing sources for the company.

The cumulative feature of preferred stock may not give the preferred stockholders the right to receive current-year dividends and unpaid prior-year dividends before common stockholders receive any dividends. Check all that apply have the right to receive dividends only in the years the board of directors declares dividends. This type of preferred stockis oled Cumulative preferred.

Choo Cumulative feature Enables stockholders to maintain their same percentage ownership when Retained earnings new shares are issued. Cumulative shareholders will receive both current year and unpaid past dividends before anything is paid out to common shareholders. This category of shareholders is entitled to dividends for a particular year regardless of the fact that the company has declared dividends for the particular year or not.

A cumulative dividends preference means that. That is cumulative have the right to receive dividends in arrears once dividends are declared. However in the case of cumulative preferred shareholders the company has an obligation of ensuring that such shareholders receive all their pending dividends.

Cumulative dividend payments are made on a first-incurred first-paid basis. All dividends in arrears plus the current years dividends. December 31 2009 Dividend.

Have the right to receive dividends only in the years the board of directors declares dividends. This problem has been solved. Whereas the right of the preferred shareholder to have her stock repurchased by the corporation for cash is referred to as a _____ right.

This term sheet outlines the companys terms of investment. 250000 007 17500 Thus the entire 16500 was paid to preferred stockholders. Investors who own cumulative preferred shares are entitled to any missed or omitted dividends.

Once all cumulative shareholders receive. Unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends. The participating preferred shareholders would receive 10 million but also would be entitled to 20 of the remaining proceeds 10 million in this case 20 x 60 million -.

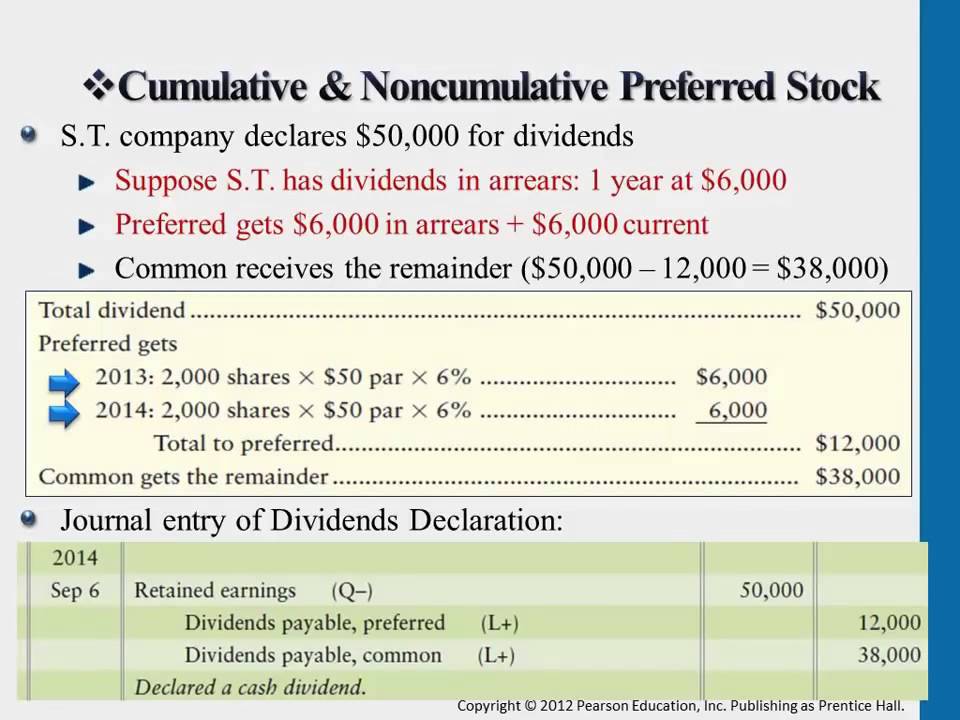

Cumulative Noncumulative Preferred Stock Youtube

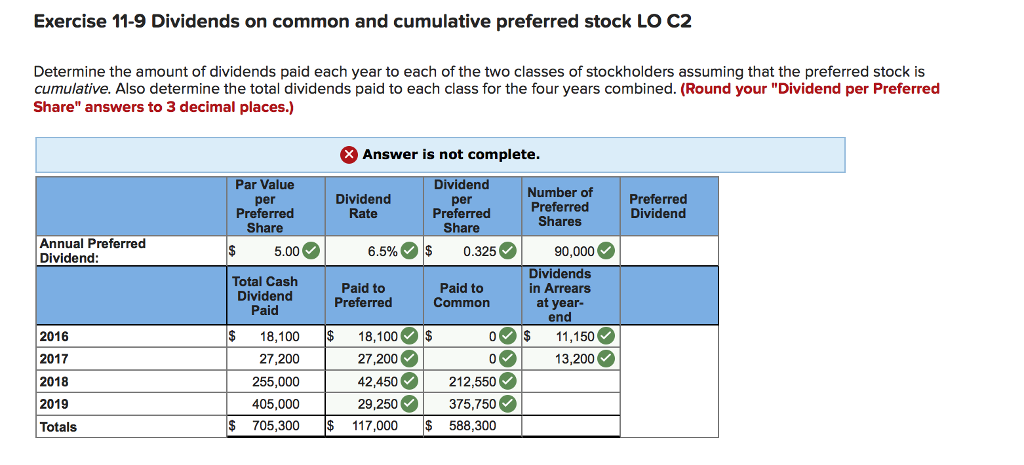

Solved York S Outstanding Stock Consists Of 90 000 Shares Of Chegg Com

Common And Preferred Stock Principlesofaccounting Com

Cumulative Preferred Stock Definition Business Example Advantages

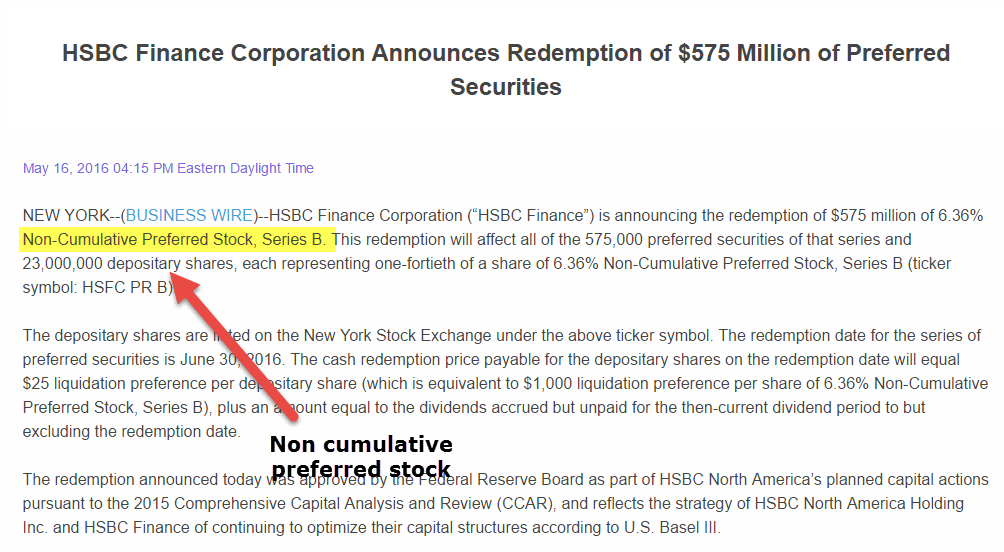

Non Cumulative Preference Shares Stock Top Examples Advantages

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Preferred Stock Accountingcoach

Preferred Shares Meaning Examples Top 6 Types

Solved Colliers Inc Has 100 000 Shares Of Cumulative Chegg Com

Preferred Shares Meaning Examples Top 6 Types

Preferred Shares Meaning Examples Top 6 Types

Noncumulative Definition And Examples

Corporations Formation And Capital Stock Transactions Ppt Download

Preferred Dividend Definition Formula How To Calculate

Cumulative Preferred Stock Definition

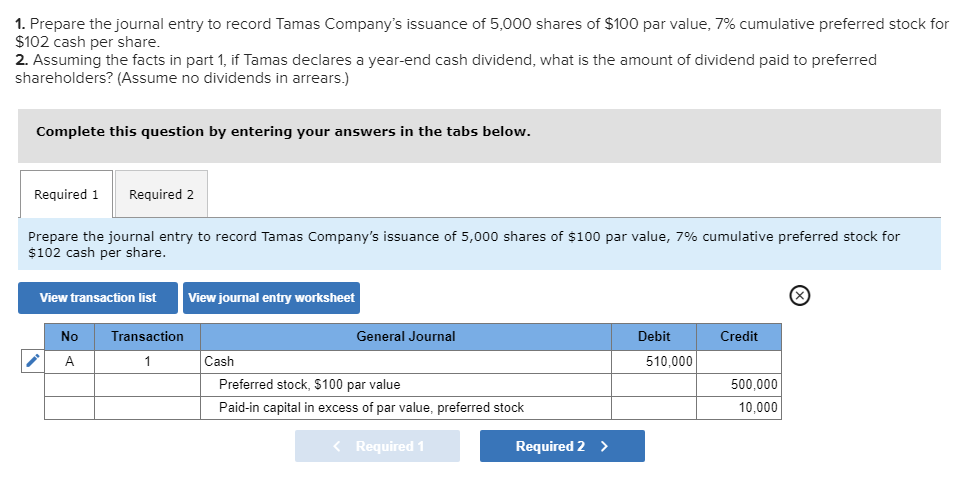

Solved 1 Prepare The Journal Entry To Record Tamas Chegg Com

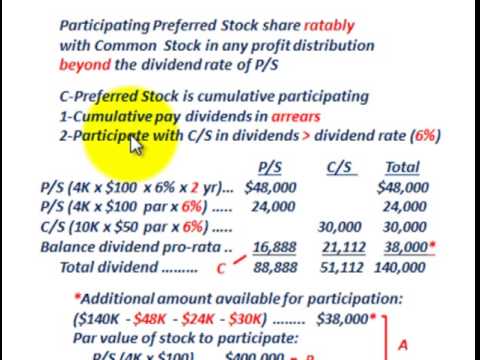

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Difference Between Cumulative And Non Cumulative Preferred Stocks With Table Ask Any Difference

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube